What Is Investing? Why Should I Invest?

Investing is like climbing a mountain. You set your sights on a certain goal, be it the summit, or your portfolio value. It’s never a straight path to reach the goal. Sometimes you have to take a few steps backward to find a better route before you climb some more.

Mountains will challenge you with unpredictable challenges. One day it is clear and you can make great progress. But the next, there may be a snowstorm or strong winds that slow you down.

A good climber makes adjustments with new strategies and tools on the mountain. Investors can do the same. We make adjustments to our portfolio as economic conditions change. Not everybody takes the same path or climbs the same mountain.

This decision is very personal and must be based on your own experience, tolerance for risk and time horizon. The key to successful investing is to understand what kind of investor you are.

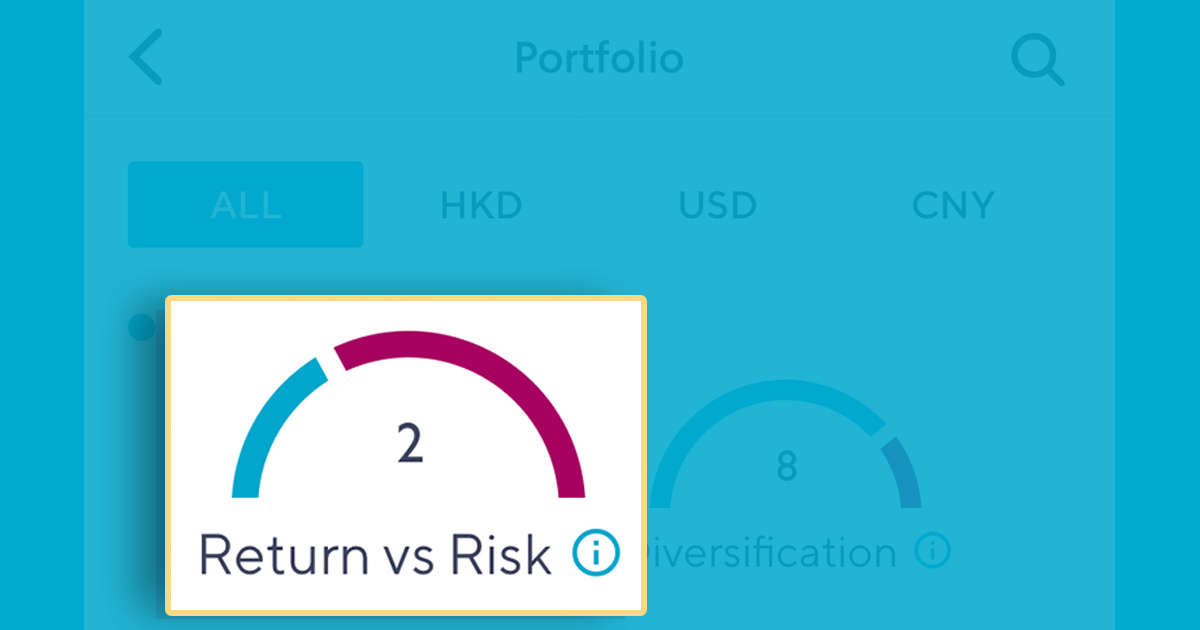

Understanding Returns vs. Risk

To ultimately get returns. Unfortunately for investors, returns always come with a certain level of risk. When making investments, one must always consider the balance between risk and return. In order to further understand this relationship, investors use certain tools, or “risk” measures.

These measures are used to calculate the risk adjusted return of an investment. Risk adjusted return is simply how much return your investment made, relative to the amount of risk the investment had over a certain period of time.

Say you have two investments that produce exactly the same returns – if one of these investments had a lower risk level, then it would have the better risk adjusted return.

This is also better known as the Sharpe ratio. It calculates the risk adjusted return of a certain portfolio or investment. In other words, it indicates how much return you are getting in regards to the amount of risk you are taking. Generally, the greater the Sharpe ratio value, the better the risk adjusted returns tend to be.

This may seem overwhelming, however, you don’t need to worry about calculating the Sharpe ratio, as this feature is included in the SoFi Hong Kong App where we call it the “Return vs Risk” score.*

*The in-app Return vs. Risk Score (“The Scores”) are assumed figures presented for informational purposes only, and are neither an indication, prediction, forecast nor guarantee of future performance results of an investment, and may differ to the original formula. The Scores are based upon sources of information believed to be reliable. Such information and Scores have not been independently verified and the SoFi Hong Kong makes no guarantees to their accuracy, completeness, timeliness or correctness.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.