Week Ahead on Wall Street: Why Interest Rates Matter

Estimated reading time: 6 minutes

Some Have It Better

Last week’s Fed meeting came and went, as did another week of investors looking for any new hints where interest rates might go. But why do we even care, really? Do interest rates actually matter as much as investors seem to think they do?

Interest rates can be thought of as the cost of accessing money: It’s the match between someone who wants to do something but doesn’t have the money and someone who does. If you’re the borrower interest is the amount you pay, whereas if you’re the lender it’s the amount you earn.

This is where the Fed comes in. The central bank determines the federal funds rate – the rate financial institutions pay to borrow from each other overnight. Without getting lost in all the minutiae, other interest rates generally piggyback off of this one, so if the Fed decides to change the rate, that should be reflected in other interest rates.

There’s a caveat here though: Certain debt types are more directly tied to the federal funds rate than others. Small business loans, auto loans, high yield bonds and small-cap company debt for example, are often tied to a short-term interest rate benchmark, such as the federal funds rate, and may even be structured as floating rate debt that can adjust depending on the benchmark rate. Meanwhile, mortgages, investment grade bonds, and large-cap company debt are more often tied to longer-term benchmarks, such as the 10-Year Treasury yield.

Here’s where it gets more complicated: Treasury yields are determined by where investors think interest rates will be in the future, not just right now. So when investors expect rate cuts from the Fed – as they currently do – longer-term Treasury yields fall in expectation of future lower rates. And sometimes they fall even below shorter-term yields; that’s when we talk about yield curve inversion. In other words, larger companies may borrow against a lower benchmark than smaller companies. And because larger companies tend to have better credit ratings and less overall debt, they’re also usually charged less of a risk premium when borrowing, too.

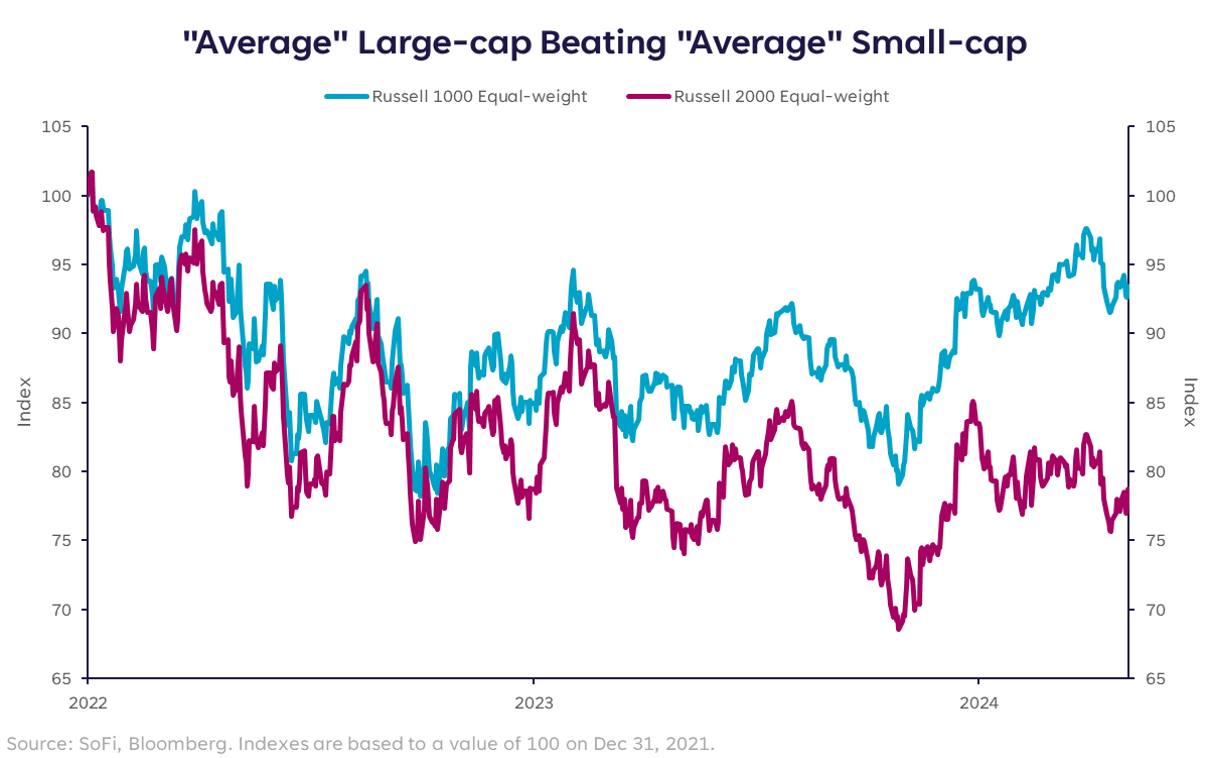

This dynamic has contributed to a bifurcated market, where the largest companies borrow at relatively moderate rates, while smaller companies and consumers feel more of the pinch. We can see this in consumer sentiment, as high borrowing costs have made it tougher for consumers to buy homes, cars, and other big-ticket items. Similarly, large-cap stocks have comfortably outperformed small-caps as the fed funds rate marched higher.

That’s why everyone listens when Fed officials speak on the path of interest rates. And with their communications blackout period over, it’s time to listen once again.

Economic and Earnings Calendar

Monday

- Quarterly Senior Loan Officer Opinion Survey: This is a survey of large domestic banks, as well as U.S. branches and agencies of foreign banks, on bank lending practices and loan demand.

- Fedspeak: Richmond Fed President Richard Barkin will speak on the economic outlook. New York Fed President John Williams will take part in a fireside chat at the Milken Institute.

- Earnings: Axon Enterprise (AXON) , Fidelity National Information Services (FIS), FMC (FMC), International Flavors & Fragrances (IFF), Loews (L), Microchip Technology (MCHP), Realty Income (O), Simon Property Group (SPG), Tyson Foods (TSN), Vertex Pharmaceuticals (VRTX), Williams Companies (WMB)

Tuesday

- March Consumer Credit: Borrowing activity gives insight into broader economic activity. It has trended lower as interest rates have risen.

- Fedspeak: Minneapolis Fed President Neel Kashkari will take part in a fireside chat at the Milken Institute.

- Earnings: Assurant (AIZ), Arista Networks (ANET), Bio-Rad Laboratories (BIO), Builders FirstSource (BLDR), Disney (DIS), Duke Energy (DUK), Electronic Arts (EA), Expeditors International of Washington (EXPD), Henry Schein (HSIC), Jacobs Engineering Group (J), Jack Henry & Associates (JKHY), Kenvue Inc. (KVUE), McKesson (MCK), MarketAxess Holdings (MKTX), Match Group (MTCH), NRG Energy (NRG), Occidental Petroleum (OXY), Rockwell Automation (ROK), Sempra Energy (SRE), TransDigm Group (TDG), Waters (WAT), Wynn Resorts (WYNN)

Wednesday

- March Wholesale Inventories and Sales: Wholesalers often operate as an intermediary between manufacturers and retailers, serving as a key part of the goods supply chain.

- Weekly Mortgage Applications: Mortgage activity gives insight on demand conditions in the housing market.

- Fedspeak: Fed Vice Chair Philip Jefferson will take part in a discussion on economics careers. Boston Fed President will give a speech to MIT students and take part in a fireside chat. Fed Governor Lisa Cook will discuss the Fed’s latest Financial Stability Report.

- Earnings: Airbnb (ABNB), Atmos Energy (ATO), Broadridge Financial Solutions (BR), Celanese (CE), Corpay (CPAY), Emerson Electric Co (EMR), Fox Class B (FOX), NiSource (NI), News (NWS), STERIS (STE), Uber (UBER)

Thursday

- Weekly Jobless Claims: This high frequency labor market data gives insight into filings for unemployment benefits. Jobless claims have continued to show a labor market that remains strong despite having cooled.

- Earnings: Akamai Technologies (AKAM), Constellation Energy Co (CEG), Charles River Laboratories International (CRL), EPAM Systems (EPAM), Evergy (EVRG), NortonLifeLock (GEN), Mettler-Toledo International (MTD), Insulet (PODD), Solventum (SOLV), Tapestry (TPR), Viatris (VTRS), Warner Bros. Discovery, Inc (WBD)

Friday

- May University of Michigan Consumer Sentiment: How consumers feel about economic conditions may affect their spending habits. This survey places a particular focus on inflation and its trajectory.

- Fedspeak: Fed Governor Michelle Bowman will discuss financial stability risks. Chicago Fed President Austan Goolsbee will take part in moderated Q&A at an Economic Club of Minnesota luncheon event. Fed Vice Chair for Supervision Michael Barr gives commencement speech for the American University School of Public Affairs.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, investment advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.