Week Ahead on Wall Street: Housing Jitters

Estimated reading time: 0 minutes

Inflection Point?

A nation’s housing market is often seen as a barometer for the state of its economy. Here’s what we can learn about the current state of the U.S. housing market.

Hot trends point at a hot economy, while weak trends indicate a weak economy. This is because the housing market also involves several key types of economic activity, such as everyday services consumption (e.g. electricity and rent), durable goods spending (e.g. refrigerators and stoves), and investment (e.g. homebuilding and renovations).

And it doesn’t end there: People tend to cut back on expensive things during times of economic or financial stress, making the housing market, along with its big purchases, a leading indicator for the broader economy.

With that in mind, recent weakening in housing data could be cause for concern: Despite mortgage rates continuing to trend lower, homebuilder sentiment hit the lowest level of the year, housing starts surprised to the downside last week, and existing home sales remained depressed.

This point is especially important. Mortgage rates tend to closely track movement in 7 and 10-year U.S. Treasury yields, which move up and down with economic data and sentiment. If mortgage rates were rising, it wouldn’t be shocking to see the housing market slow. But a slowing in the face of rates that are beginning to fall is especially notable.

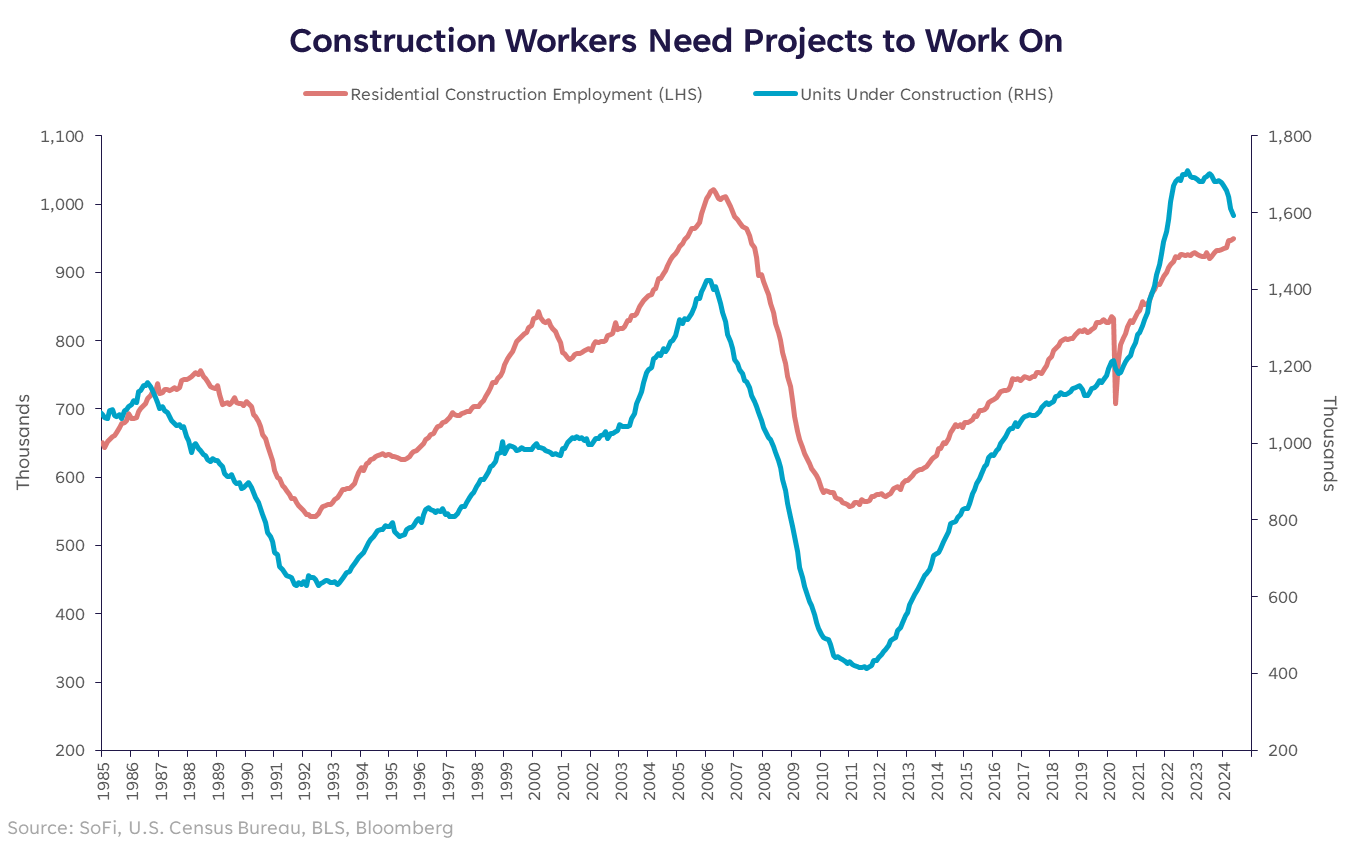

A new home moves through economic data like this: building permit >> construction start >> under construction >> completion. And it takes some time to move from one stage into another. As housing starts have trended lower in recent months, housing completions have remained near cycle highs as we work through the backlog.

It might not be obvious why that’s bad, but there’s a pretty intuitive explanation: Workers need projects to work on! If the number of homes being built declines, construction employment could fall as well. And just like housing usually leads the broader economy, the labor market for construction usually leads the overall labor market.

This week we’ll get updates on new and pending home sales, home prices, mortgage applications, and durable goods orders. All of these data points are relevant to the overall picture of the U.S. housing market. Will any of those data points on their own give us the definitive answer on where things are headed? No. But will they help us get a better idea of where we might be headed? Most certainly.

Economic and Earnings Calendar

Monday

- June Dallas Fed Manufacturing Activity: This is the Dallas Fed’s survey of manufacturing executives in the region on business conditions and their outlook

- Fedspeak: Fed Governor Christopher Waller will give opening remarks at the International Journal of Central Banking’s Annual Research Conference. San Francisco Fed President Mary Daly will participate in moderated Q&A and give remarks on monetary policy and the economy.

Tuesday

- June Philadelphia Fed Non-Manufacturing Activity: The Philadelphia Fed’s survey of services executives in the region on business conditions and their outlook.

- May Chicago Fed National Activity Index: This is a monthly index put together by this regional Fed that incorporates 85 indicators from four categories: production and income; employment, unemployment, and hours; personal consumption and housing; and sales, orders, and inventories.

- April FHFA House Price Index: This is a broad measure of single-family house prices released by the Federal Housing Finance Agency.

- April S&P CoreLogic Case-Shiller Home Price Index: This is a private sector measure of national home prices. After a period of slight decline in the second half of 2022 and early 2023, the index returned to growth and is now at record highs.

- June Conference Board Consumer Confidence: How consumers feel about economic conditions affect their spending habits. This survey places a particular focus on job availability and the state of the labor market.

- June Richmond Fed Manufacturing Activity: The Richmond Fed’s survey of manufacturing executives in the region on business conditions and their outlook.

- June Richmond Fed Non-Manufacturing Activity: The Richmond Fed’s survey of services executives in the region on business conditions and their outlook.

- June Dallas Fed Non-Manufacturing Activity: This is the Dallas Fed’s survey of services industry executives in the region on business conditions and their outlook.

- Fedspeak: Fed Governor Michelle Bowman will give a speech on monetary policy and bank capital reform. Fed Governor Lisa Cook will speak about the economic outlook at the Economic Club of New York. Fed Governor Michelle Bowman will give recorded opening remarks at the Midwest Cyber Workshop.

- Earnings: Carnival (CCL), FedEx (FDX)

Wednesday

- May New Home Sales: While only a minority of home transactions in any given month come from new constructions, these home prices tend to be more cyclical and give insight into developing trends.

- Weekly Mortgage Applications: Mortgage activity gives insight on demand conditions in the housing market.

- Earnings: General Mills (GIS), Micron Technology (MU), Paychex (PAYX)

Thursday

- 1Q GDP Third Estimate: The primary measure of economic growth in the United States, which is measured as total expenditure on a country’s goods and services. This will be the third reading of activity.

- May Wholesale Inventories: Wholesalers often operate as an intermediary between manufacturers and retailers, serving as a key part of the goods supply chain.

- May Retail Inventories: Retailers often operate as an intermediary between manufacturers, wholesalers and consumers, serving as a key part of the goods supply chain.

- May Factory and Durable Goods Orders: These metrics give insight into underlying trends for leading cyclical indicators.

- June Kansas City Fed Manufacturing Activity: The Kansas City Fed’s survey of manufacturing executives in the region on business conditions and their outlook.

- Weekly Jobless Claims: This high frequency labor market data gives insight into filings for unemployment benefits. Jobless claims have continued to show a labor market that remains strong despite having cooled.

- Earnings: McCormick & Company (MKC), Nike (NKE), Walgreens Boots Alliance (WBA)

Friday

- May Personal Income and Spending: These numbers give insight into how Americans are doing, which is important since consumer spending accounts for about two-thirds of economic growth in the United States.

- May Personal Consumption Expenditures Price Index: The Fed targets this inflation measure for its price stability mandate and believes PCE to be the best measure of consumers’ spending habits.

- June University of Michigan Consumer Sentiment: How consumers feel about economic conditions affect their spending habits. This survey places a particular focus on inflation and its trajectory.

- Fedspeak: Richmond Fed President Thomas Barkin will give a keynote speech and participate in Q&A at a Global Interdependence Center conference. Fed Governor Michelle Bowman will participate in a moderated Q&A.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, investment advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.