The Tech Sector

Estimated reading time: 0 minutes

Semi-Soft Market

The beloved technology sector has made more headlines over the past two years than all other sectors combined. Although we typically talk about it as a broad group of stocks, or a more narrow subset such as the Magnificent Seven, one of the emerging stories has been around the industry groups within technology — namely, semiconductors versus software.

Year-to-date, semiconductors are up 75% and have far outpaced software, and this comes after semis returned a whopping 98% in 2023. The group has produced exceptional returns on an absolute basis and relative to history — the average annual return for semiconductors is only 16%.

Software, on the other hand, is up 14% YTD, which is in line with its average annual return of 14%. In 2023, software had a standout year returning 49% and beating its annual average… but semis returned twice as much and stole the spotlight.

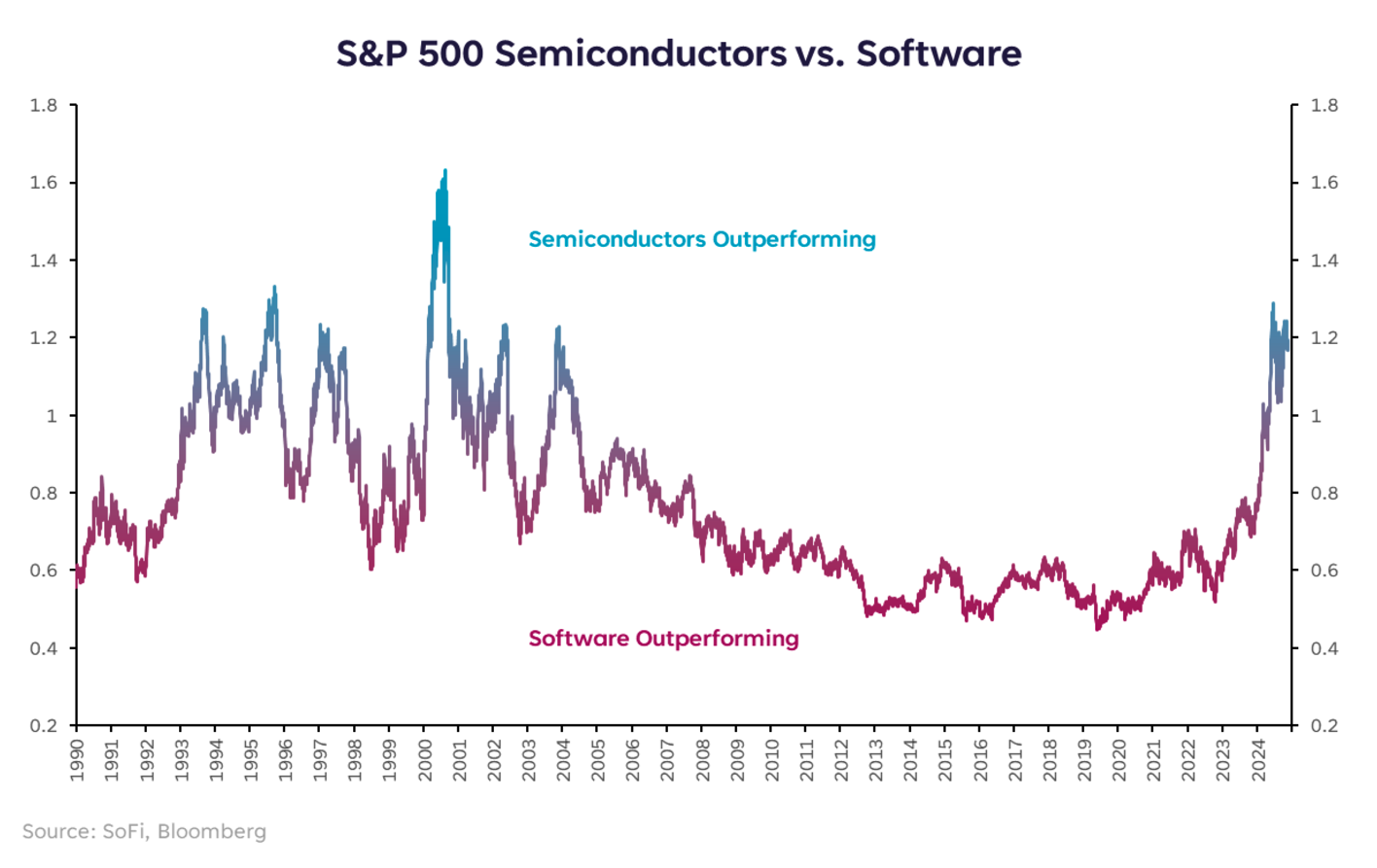

We can see this in the chart below, which shows the performance of semiconductors relative to software. Not quite back to the extremes of 2000, but the movement in this chart since early 2023 is remarkable.

Safe to say, semis have been the darling of the tech sector for the better part of two years, but can it stay that way?

Earn and Burn

This column was written before Nvidia’s third-quarter earnings report came out. That said, this piece is an analysis that wouldn’t be completely skewed by one company’s quarterly results, so the takeaways don’t change regardless of what happened with Nvidia.

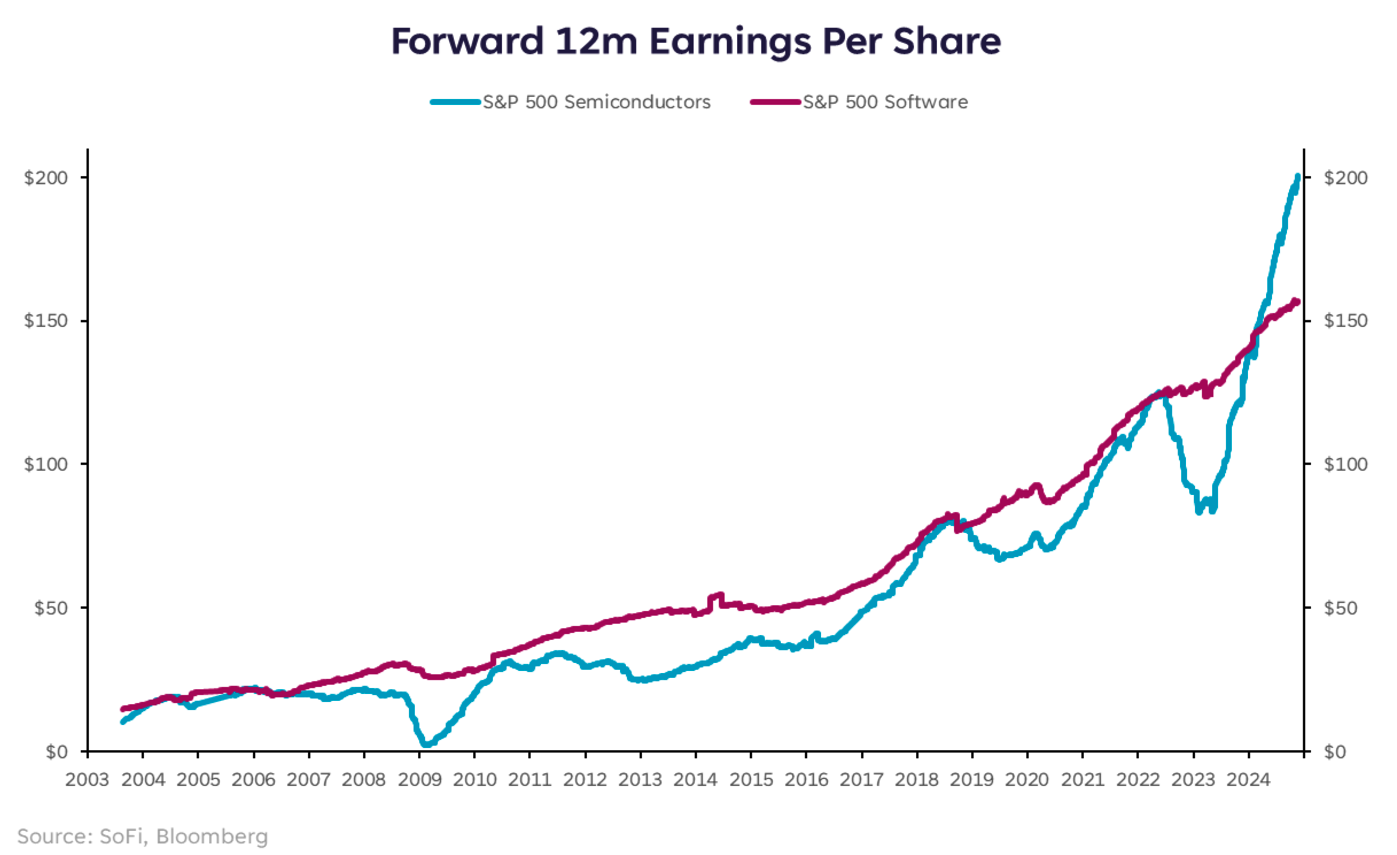

For the fundamentalists out there, one of the big reasons semis have done so well is because they’ve produced better earnings results than software. We recognize that a large portion of this has been Nvidia, but nevertheless, earnings per share for the semiconductor group as a whole are above software by the widest margin since this data began in August 2003. If stock prices follow earnings growth, it’s no wonder semis have gone parabolic.

To the question of whether this can continue, earnings growth in 2025 is expected to be 67% for semiconductors and 17% for software. If those results come true, the outperformance can continue… as long as stocks are trading only on the fundamentals. But we know that’s not usually the case in the short-term.

The Source Matters

Earnings growth is a critically important factor to consider when investing, especially over long-term periods. It shows that a company is able to maintain an attractive revenue growth trajectory while managing costs and margins appropriately. It also reflects a company’s ability to grow, improve its competitive positioning, or in the case of semiconductors currently, innovate to create new markets and new levels of future growth.

The bottom line: Don’t fight the trend in earnings growth over long-term periods.

However, in shorter timeframes, markets can move in contradictory ways, particularly when most investors are positioned for a certain result. Earnings growth matters, but so does positioning and so does sentiment. All three can cause a stock price to change direction quickly and considerably.

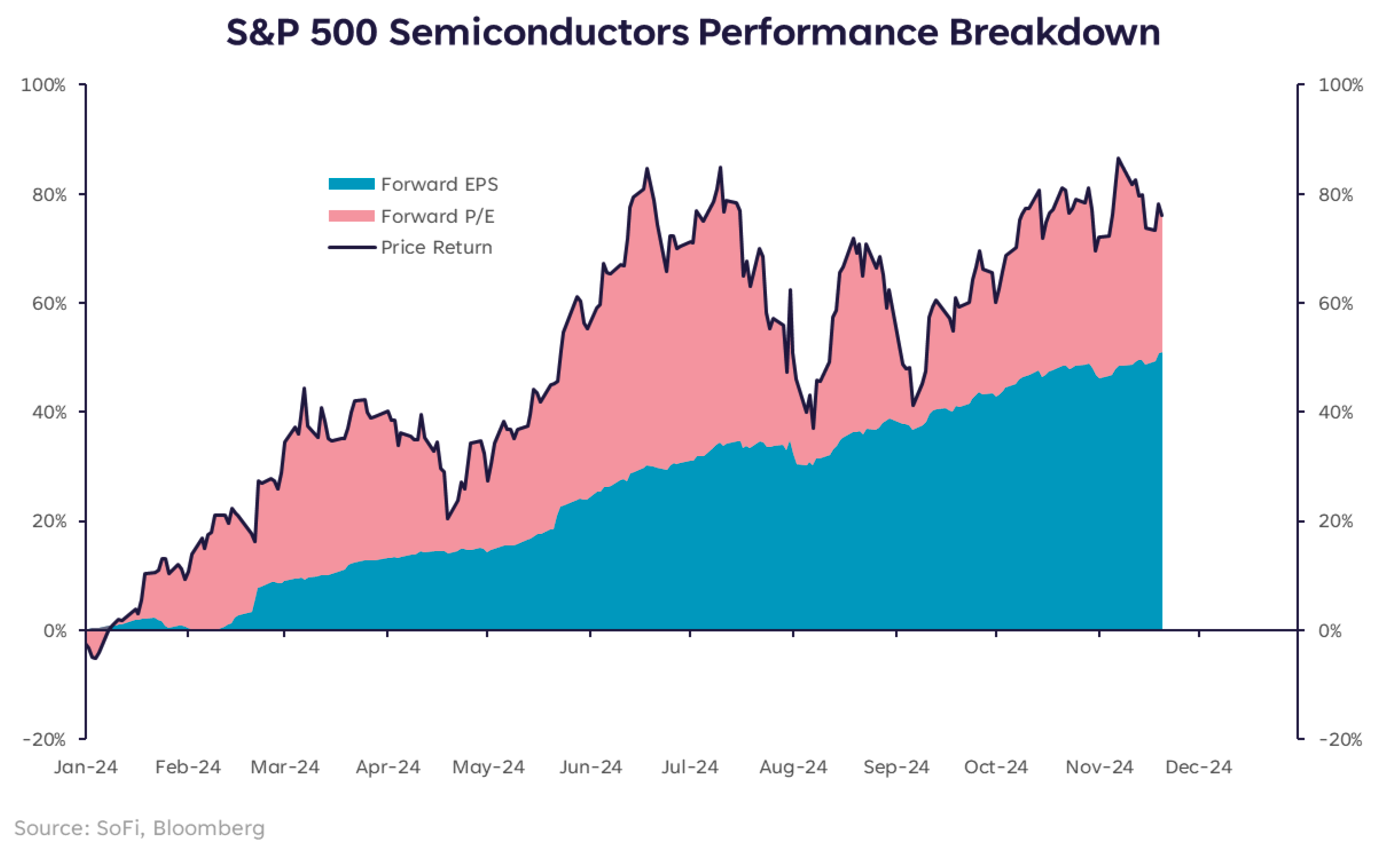

The last chart we think is very important to keep in mind as we enter a new calendar year is the one below. This is only for the semiconductor group, but it’s a concept that applies across sectors and industries.

We mentioned earlier that semis are up 75% YTD, and we can see here that about ⅔ of that return can be attributed to positive earnings results (blue), while the other ⅓ can be attributed to what’s called “multiple expansion” shown below as the forward price-to-earnings ratio (pink).

Multiple expansion is the less concrete portion of the gains, and can be largely driven by market sentiment, macro factors, news headlines, or other intangible forces. As such, this portion of the return can be more fragile and volatile, as is also apparent in the chart.

The main question we’re trying to answer here is not whether tech in general can continue its gains, but whether semiconductors can continue to outpace software by such a wide margin. After looking at some of the data presented here, there are items in the yes column and items in the no column.

As far as earnings growth expectations are concerned, yes semiconductors still appear to be the superior industry group heading into 2025. But when we look at the price action that has already occurred, the proportion of returns that comes from multiple expansion, and the wide and rare margin between earnings per share of the two groups, it looks more like managing risk in semiconductor stocks is a smart move at this juncture.

Moreover, semiconductors tend to be a more cyclically sensitive group, while software is looked at as a more defensive area of technology. If sentiment for the next 12 months becomes more defensive, or if political forces cause volatility, software has a better chance to pull ahead, in my opinion. In fact, during the most recent bout of market bumpiness since November 8, software has fared better than semis.

Just because a group has done well for a while doesn’t necessarily mean it’s “due” for any kind of pullback. But this is a period where valuations have come under the microscope more, and as investors look at the two years of standout semiconductor returns, it may make sense to rotate into a technology group that may have more room to grow as the AI life cycle plays out. Don’t sleep on software.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, investment advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.