Scenarios

Estimated reading time: 0 minutes

The conversation about currencies died down a bit while earnings announcements took center stage, and with the U.S. dollar losing a little steam over the past month there hasn’t been quite as much to talk about.

Moreover, with rate cuts not expected until fall at the earliest, the effects of monetary policy on currency moves continues to be a thing we know we’ll need to pay attention to at some point, just maybe not yet.

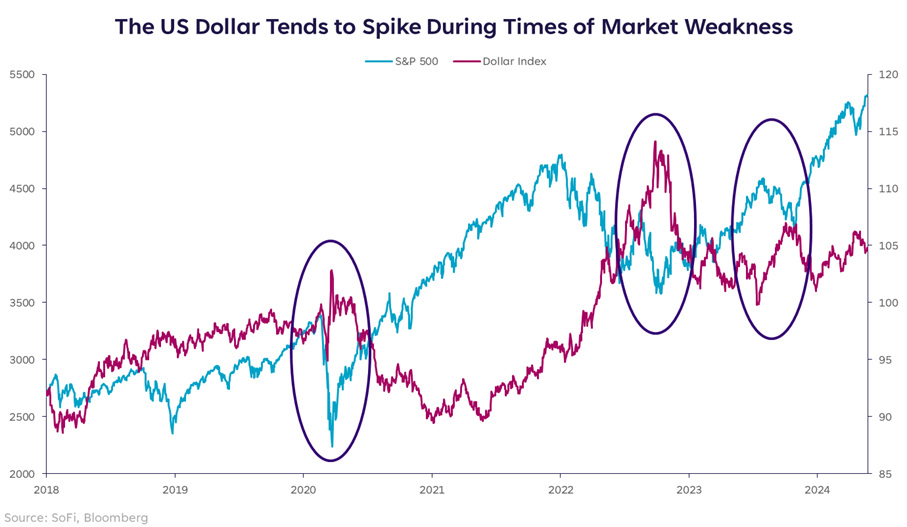

The most straightforward connection between the dollar and markets happens in times of stress: When market volatility rises and stocks fall, the dollar typically spikes as investors pile into safe haven trades, such as Treasurys.

That relationship is one we can count on, but it really only shows up in those relatively brief periods of turbulence. Much like the John Lennon quote, “life is what happens while you’re busy making other plans,” there’s a lot that happens between those extreme periods of volatility that’s just as important to be aware of as investors.

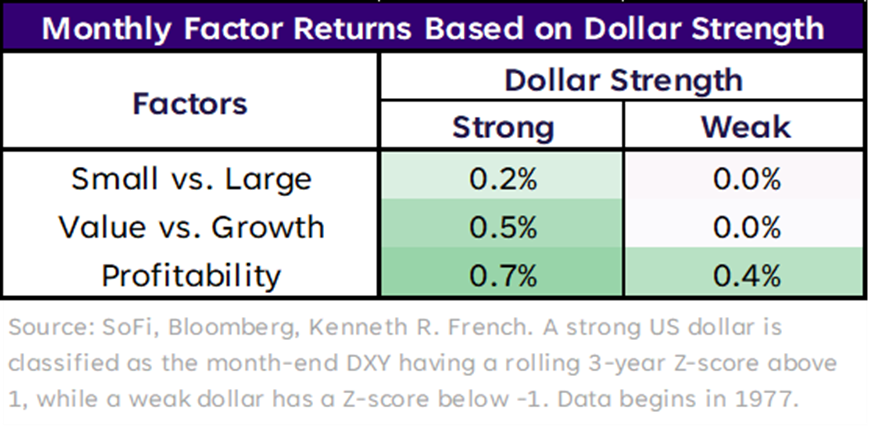

We took a look at how different factors perform during periods of dollar strength and weakness, and focused on the factors that get the most attention: market cap size, value versus growth, and profitability.

What you can see in the table below is that being choosy about factors pays off in strong dollar environments, but matters much less in weak dollar environments. If we expect that the Fed will start to lower rates later this year, we might also expect that the US dollar could give up some strength as rates fall. In which case, don’t overthink the portfolio exposure based on factors. Sometimes simplicity is the best solution.

This makes intuitive sense if we consider what else might be going on if the Fed is lowering rates and the dollar is retracing some of its rise. If the dollar is weakening, chances are that levels of global fear are low, and if the Fed starts lowering rates methodically rather than quickly in response to bad news, chances are that the US economy is also on firm footing. Both of these conditions would create a friendly environment for stocks broadly.

What Else?

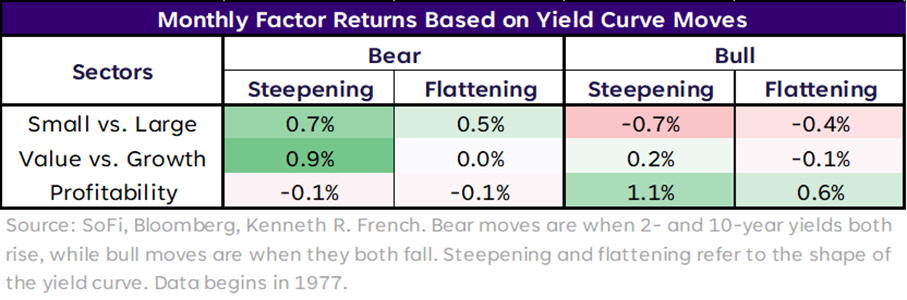

As with most things market-related, there are cross-currents that can complicate the situation. One such cross-current we would add is the yield curve. This is a topic I’ve discussed in recent weeks, as I do expect the yield curve to see a bull flattening environment as the economy cools, then a bull steepening environment as the Fed embarks on a cutting cycle.

Revisiting our factor analysis, we can see that being choosy about factors does actually matter as the yield curve moves. Specifically, small-cap stocks tend to notably underperform large-caps in the bull steepening and flattening periods, which makes sense given both of these would be occurring late in the business cycle.

The takeaway for value versus growth is less convincing in either direction, and profitability wins in both bull scenarios, which is no surprise.

When we add these forces together and look at the possibility of a weak dollar environment in concert with a bull steepening or flattening yield curve, we come up with late-cycle positioning with an eye on profitability.

Said more plainly, large-caps continue to appear attractive relative to small-caps, a balance between value and growth seems ideal, and a skew towards companies that have healthy margins is important. Stay invested, but don’t overcomplicate or overconcentrate.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, investment advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.