Rate Effect

Estimated reading time: 0 minutes

The Higher the Better?

A recent debate that has surfaced is the idea of higher interest rates actually being stimulative for the economy, rather than the conventional theory of them restricting economic activity. Like many debates over macro and market drivers, this one isn’t cut-and-dry, but we dug deeper to try to suss out any evidence that high rates are helping consumers rather than hurting them.

The crux of the argument is that the roughly 5% interest investors can earn on Treasurys, money market funds, and other savings instruments such as certificates of deposit, is supplementing consumer cash flow enough to allow for a higher level of spending. In addition, this increased interest income could make consumer debt burdens less… burdensome.

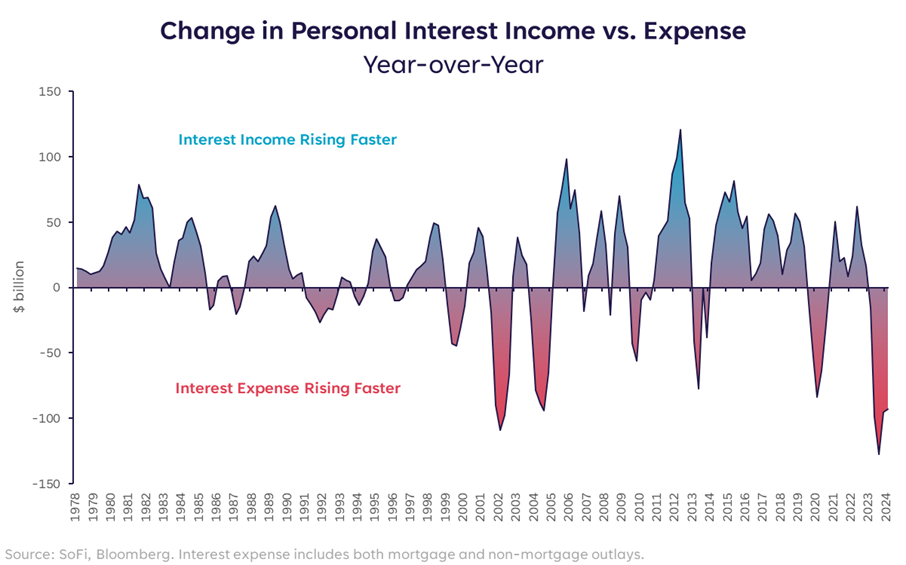

In order to ascertain whether this was in fact the case, we took a look at the change in personal interest income (what consumers receive from savings instruments and Treasurys) vs. interest expense (what consumers pay in interest on mortgages and other consumer loans). If higher rates were producing enough extra income we would expect the interest income to be rising faster than the interest expense, but that hasn’t been the case since late 2022.

This data suggests that higher rates are not, on the whole, providing excess cash for consumers to spend. The intangible aspect that we can’t know is how higher interest income is affecting the psychology of consumers.

It’s possible that the ability to generate attractive interest on relatively risk-free assets has consumers feeling more positive about their cash flow and ability to spend, which keeps demand elevated and explains the strong consumption we’ve continued to see in GDP.

Additionally, we can’t really know where each dollar of spending is coming from, whether from interest income, other income, or credit. All we know is that people are still spending.

Cost Composition

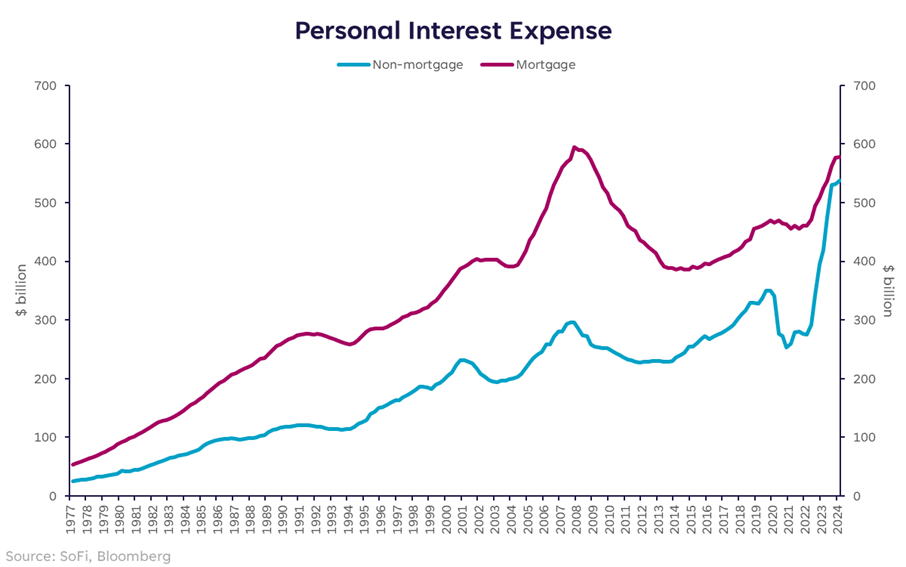

Another aspect that’s important to consider is where the interest expense is going. Given the higher level of rates, we would expect that interest costs on all types of loans have risen, but as we can see in the chart below, the cost of non-mortgage debt has risen substantially more than mortgage debt.

In some ways this makes sense: mortgage rates are typically quite a bit lower than rates on credit cards, personal loans, or auto loans, but the amount borrowed in mortgages is typically quite a bit higher.

Over time, the percentage of total interest expense that’s attributable to mortgages vs. non-mortgages has changed considerably. Pre-pandemic, 57.6% of interest expense was going toward mortgages, while only 42.4% was going toward other types of loans. Today, that’s almost an even split with 51.8% toward mortgages and 48.2% toward other loans.

Perhaps it’s a matter of opinion whether mortgage debt or other debt is better or worse, but it’s worth noting that the source of the expense has shifted. It’s impossible to know the exact details of what type of consumer has increased their non-mortgage borrowing, or what exactly they’re using the borrowed money for, but it is clear in this chart that higher rates on lending products have presented consumers with a larger debt burden to contend with.

Borrowing Isn’t Always Bad

Part of why this topic still remains a debate without a clear answer is because during times of economic expansion, consumer borrowing tends to increase. Moreover, in order to stimulate an economy, rates are lowered in order to make lending and borrowing more fluid between financial institutions and consumers. Borrowing activity isn’t a surefire bad sign in and of itself. In fact, it can sometimes be a good sign and one that indicates the presence of more free-flowing capital.

Borrowing turns into a problem when consumers can no longer service the debt, or when the interest expense on the debt continues to make the debt rise, which will end up eating into spending ability rather than expanding it. There are some indications that some consumers are nearing or already in this danger zone, but there hasn’t been a broad economic implication yet. Perhaps there won’t be, but this is something I think is critical to watch.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, investment advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.