Looking at: Growth

Estimated reading time: 5 minutes

Growing Pains

Children of the 1980s know the show Growing Pains well, and hopefully many of you are quietly humming the theme song (if you’re not, this should help: “As long as we’ve got each other, we’ve got the world spinning right in our hands…”).

The reality is that growing pains are a part of life… and economics. We spend an inordinate amount of time speculating on what future growth rates will be — growth in earnings, growth in revenue, growth in index levels, and growth in GDP, to name a few.

By the time this blog post drops, we will have our first read of Q2 GDP for the U.S. Current expectations are for 2% growth year-over-year, followed by 1.5% for both Q3 and Q4. According to the Fed’s projections, long-term growth should run at 1.8%, which means the expectations for the second half of this year are below trend.

That in-and-of-itself is not too alarming since the Fed has said for a long time that we would need a period of below trend growth in order to take care of inflation. Perhaps this is exactly according to plan.

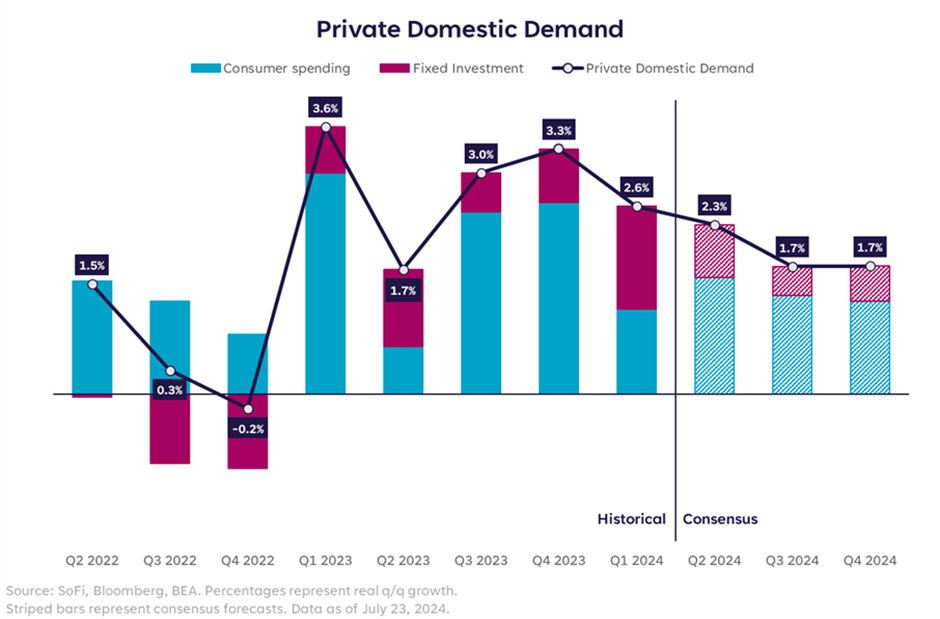

One of the components we will be watching closely is Private Domestic Demand, which is the combination of consumer spending and fixed investment, and a good measure of economic vibes from the spendy and more sensitive parts of our economy as it strips out trade, government spending, and inventories from the calculation.

Private domestic demand has been strong for the last three quarters and continues to show strength in Q2 projections, but much like the overall GDP expectations, the expectation is for it to weaken to below 2% in the remainder of the year. Given that this is what we typically rely on for stability and spending strength, it’s an important trend to watch for indications of further weakness.

Who’s the Boss?

The consumer is the boss in the U.S., making up 69% of GDP. There are a number of ways to watch what the consumer is doing, with perhaps the broadest read being retail sales — which can be a bumpy and unpredictable dataset month-to-month — but has weakened in recent months nevertheless.

On top of that, some recent earnings results from bellwether companies have been lackluster this quarter: UPS (UPS) missed estimates and had its worst day in markets in 25 years, and Visa (V) missed on revenue. We’re only 27% of the way through earnings season so far, with many of the retail companies reporting in coming weeks.

We would expect commentary to be less optimistic than it has been in prior quarters, but not particularly lousy. This earnings season may simply serve as confirmation that the consumer has in fact, pulled back a bit and become more discerning about what they spend money on. Again, not ominous in-and-of-itself, but an indication that the belt is tightening and companies are taking notice.

After many quarters of worrying about Chinese consumer spending, the slowdown hasn’t had as much of an effect on U.S. companies as feared, which is a good thing. But if the weakness continues, it may pile onto any weakness in the U.S. consumer and drag earnings down for retail companies. One of the bellwether European brands that’s sensitive to Chinese consumption is LVMH, which missed estimates for Q2.

At the very least, there are rumblings of a global consumer slowdown. Given that we’ve spent the last three years concerned about global inflation, a slowdown in spending may be what’s necessary to bring supply, demand, and consequently, prices back to a more comfortable level. But anytime the consumer starts to slow its spending, we have to watch closely. As we near the first Fed cut and focus more on a cooling labor market, consumers are likely to show us how they really feel about the economy.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, investment advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.