Decoding Markets: The Fed’s March Statement

Estimated reading time: 5 minutes

Stuck in Transition

The first Federal Reserve meeting of the year was seven weeks ago, though it feels like it’s been longer, given all that has happened in markets since. Despite that, the Fed’s decision this week was much like the last: The Federal Open Market Committee (FOMC) left its benchmark interest rate unchanged at a range of 4.25%-4.50%.

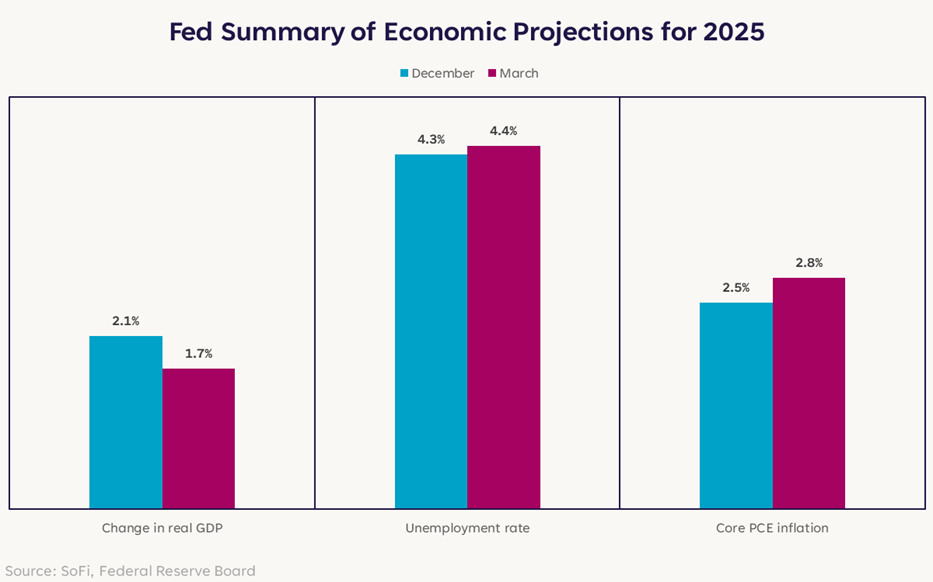

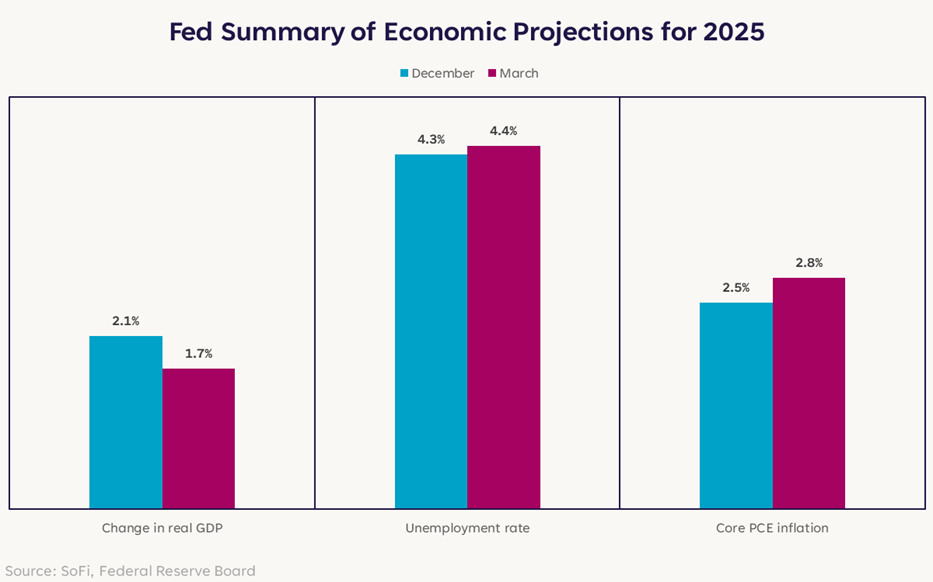

No change in interest rates wasn’t a big surprise. Market pricing indicated less than a 1% chance of a change going into the meeting. Instead, investors were primarily focused on what Fed officials thought about the outlook moving forward. Some attention was given to changes in the official statement versus the prior one, though a good chunk of investor focus went to the quarterly Summary of Economic Projections (SEP). There were some changes on that front.

Given the increase in economic policy uncertainty since the December SEP, it’s not a surprise that the revisions to the outlook were mostly negative across the board: lower growth, higher unemployment, and higher inflation.

Stagflation Risks

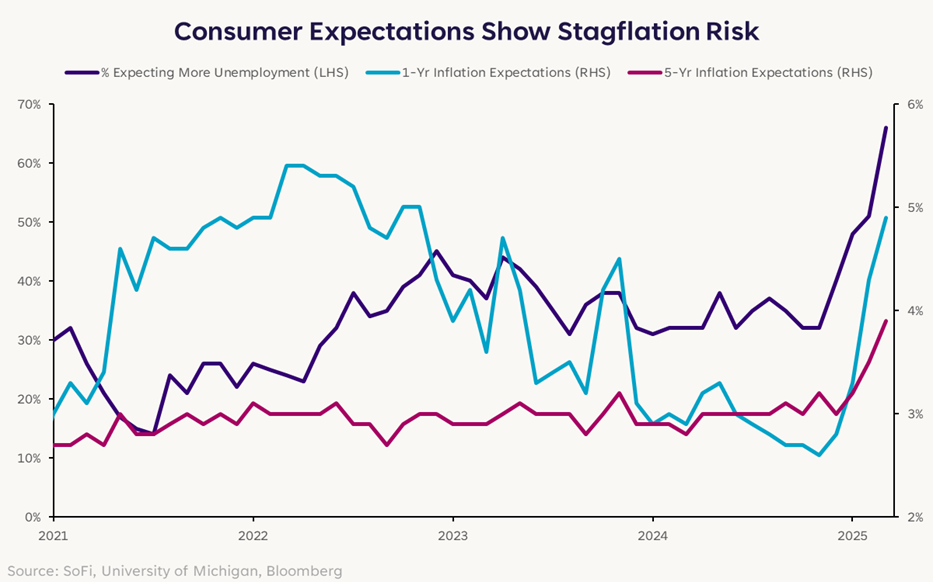

Stagflation is a dreaded word in markets. Most often associated with the 1970s, it is generally defined as a period of weak growth, as well as high unemployment and inflation. While few are arguing that a repeat of the 1970s awaits the U.S. economy, market watchers have been increasingly pricing in the possibility of something incrementally more stagflationary. Or in other words, lower growth, higher unemployment, and higher inflation. Consumers have been feeling it too, with the University of Michigan’s survey of consumers showing rising inflation and unemployment expectations.

In that sense, the latest SEP revisions weren’t necessarily breaking news — Fed Chair Jerome Powell called attention to uncertainty and tariffs multiple times in his post-meeting press conference. Instead, they’re a reflection of the same factors that contributed to the 10% S&P 500 drawdown from February 19 to March 13.

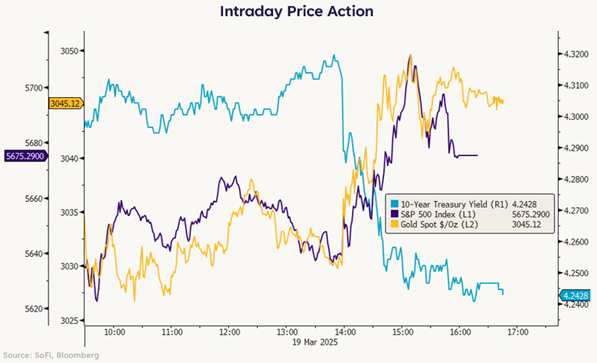

For now, investors have decided to focus on the positives. The median Fed official maintained their expectation for two interest rate cuts in 2025. Additionally, Powell suggested that the Fed was willing to look past tariffs if they didn’t feed into broader inflation, while also downplaying the idea that recession risk was high. The fact that the negatives were mostly already priced in, while investors got some positive nuggets to focus on, may help explain why stocks and gold actually rose an additional 0.7% and 0.5% respectively, and 10-year Treasury yields fell 7 basis points, after the Fed decision.

At a Crossroads

Investors may be getting some respite after a tough few weeks, but when all is said and done, the economy and fundamentals matter. Coming into 2025, unemployment was low, economic growth was above-trend, and corporate profit margins were robust. Nonetheless, tariff threats and the possibility of a global trade war — one that includes our most important trading partners — chip away at those strengths.

Uncertainty on what the operating environment will look like down the road can make it difficult for businesses to accurately forecast demand and make informed decisions. That could lead to businesses adopting a more cautious approach, delaying or scaling back CapEx and expansion plans until there is greater clarity and stability in the market. That hesitancy can, in turn, weigh on activity the longer it lasts.

With the April tariffs looming and not much clarity about what will be included — or if the tariffs even get imposed — the uncertainty that has gripped markets could be here for a while longer. Until that cloud clears, it’ll be hard for investor sentiment to fully recover and stocks to regain momentum in what remains a volatile trading environment.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, investment advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.