Should I Invest With A Robo Advisor?

Picture this. The investment markets are volatile and uncertain. It’s not easy to pick investments, to monitor your portfolio and make adjustments during uncertain times. You might even be a newbie to investing and all of this might just be a bit too much for you!

Why Robo Advisor?

Suppose you want to put some money away and save up for a goal. A new iPhone? A Chanel handbag? A holiday to Japan? Or perhaps even an apartment down payment?

You could put some money in your savings account. But you’d make very little return with such low interest rates now.

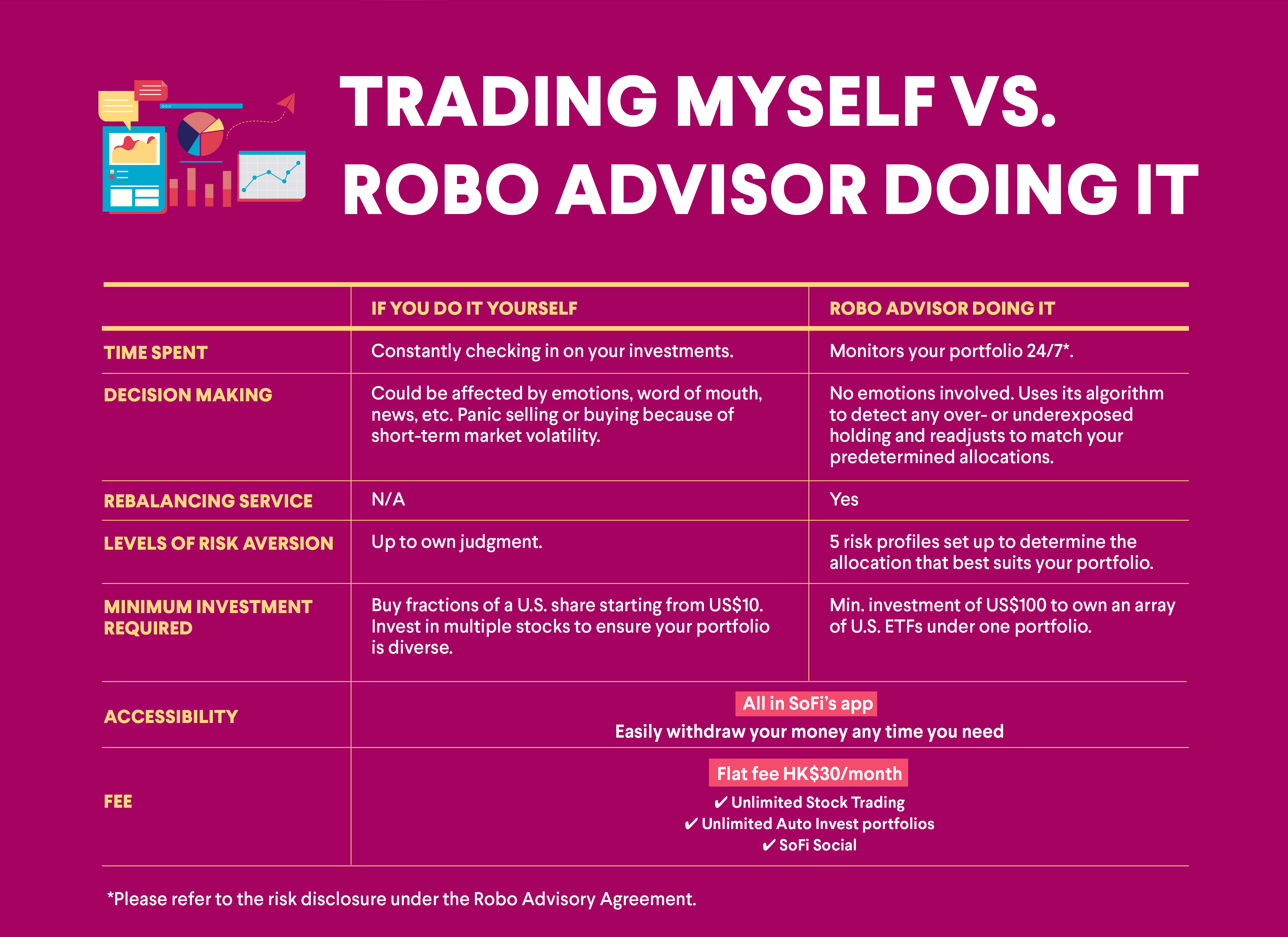

Investing in stocks is a great idea. But the stock markets are complicated, unpredictable and time consuming. You could spend hours studying them and monitoring your investments, but you might still make a loss even if you’ve done all the work. After all, even the professionals get it wrong quite often!

Our robo advisor is an algorithm that allocates your money for you into a well-designed and diversified investment portfolio. The portfolios have exposure to 13,000 stocks around the world, in over 35 countries and have exposure to equities, bonds and commodities. A robo advisor constantly monitors your investments.

And a robo advisor is never emotional! It won’t panic and make rash decisions if the stock market fluctuates. Or become too excited when your investments make a lot of gains. Just think of it as an experienced investment advisor who will look after your investments for you. Except the advisor is an artificial intelligence that always monitors your portfolio, and is probably a lot cheaper to hire!

You’ve probably heard of all the common investment advice: Manage your risk. Don’t put all your eggs into one basket. Diversify. You probably understand some of those concepts. But do you always do that?

A robo advisor does all of those for you and consistently.

What Are ETFs?

When you make an investment in our robo advisor, you are putting your money into a diversified portfolio of Exchange Traded Funds (also known as ETFs).

ETFs are like baskets of different investments. It might include stock, bonds or commodities. These investments are usually spread across different markets and industries and are picked by experienced fund managers. ETFs are usually well diversified meaning you don’t put too much risk on one type of investment.

Sure, you can probably invest in these ETFs yourself. But you probably wouldn’t monitor your investment on a daily basis, calculate what adjustments need to be made, and then sell and buy precise quantities to keep your portfolio diversified. After all – it’s a lot of work and something an artificial intelligence will do much better.

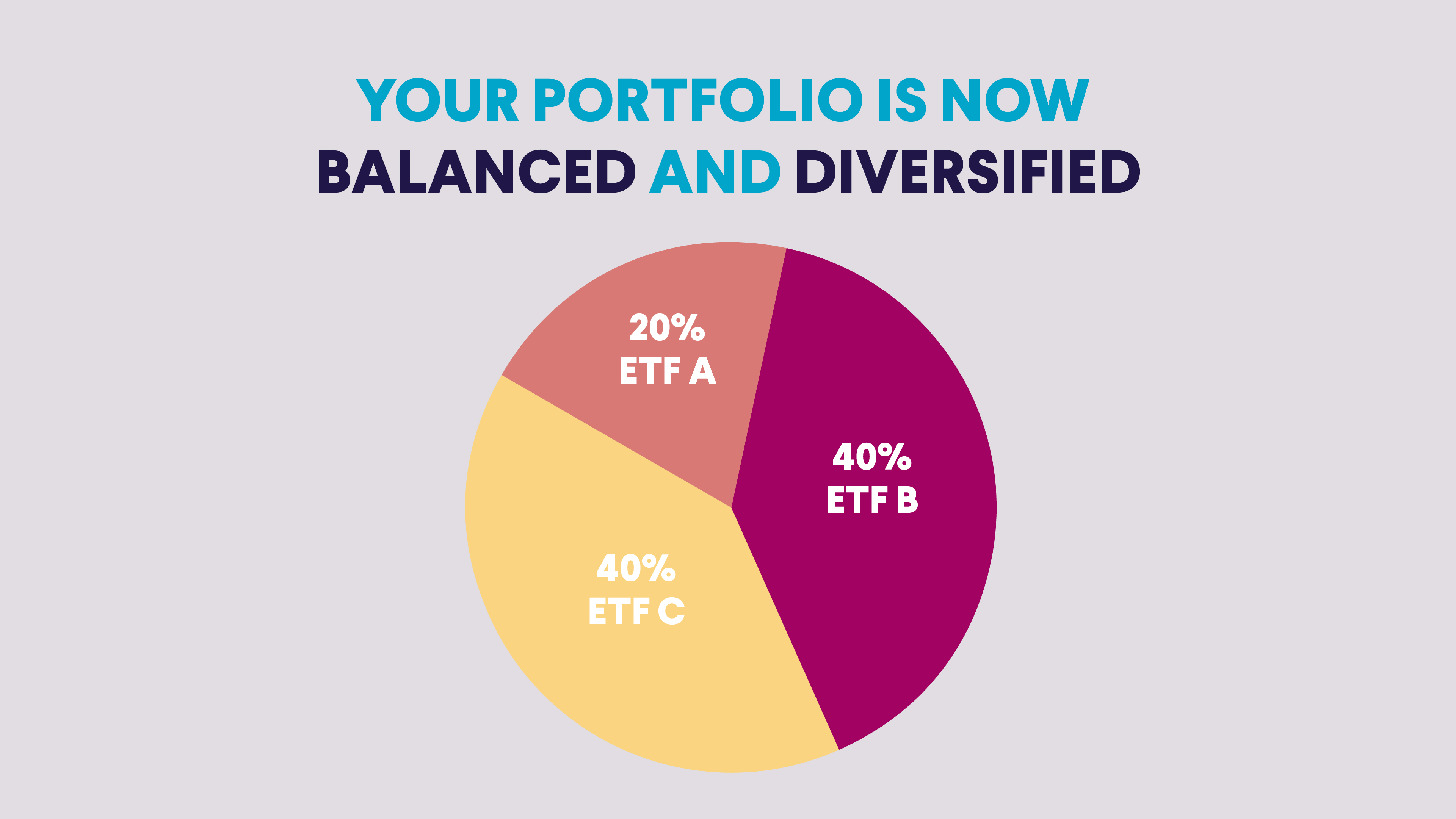

Our robo advisor will manage your risk and keep your portfolio diversified. Putting too much money on one investment is risky because if the value of it goes down… well that’s bad news.

How Does It Work? Rebalancing Explained

This is called rebalancing. A relatively straight forward process but performed with a high degree of accuracy by a well designed algorithm.

On a regular basis the robo advisor’s algorithm will sell the ETFs in your portfolio that are comparatively performing well. It then re-invests this money into the other ETFs in your portfolio that have diminished in allocation size because the better performing ETFs now make up more of your portfolio.

It probably sounds counterintuitive to sell off your best performing investments but it’s actually the sensible thing to do. If you allow that one ETF to begin to dominate your portfolio it becomes unbalanced, and you begin to increase your risk as more of your money goes into one type of investment.

By re-distributing the money to other ETFs, your investment profile is kept balanced and diversified – lessening the chances of you experiencing big losses if one of the investments fluctuates.

Again, you could do this yourself. But you’d need to constantly monitor your portfolio and make calculations to help you decide what to sell and buy. This is especially the case if you have a large portfolio of investments!

You could also hire an investment manager to do this for you…but they’re expensive. And why should you pay for their fancy offices?

Instead, you can do it cost effectively with an algorithm that is always calculating and always making sensible decisions based on data and never on emotions.

You could rely entirely on a robo advisor. But you can also have a robo advisor investment alongside stocks, ETFs and other investments you manage yourself. After all, having a diverse range of investments is also considered a good investment strategy.

Click here to learn more about how to set up Auto Invest!

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.