Looking at: Jobs Preview

Estimated reading time: 3 minutes

Anticipation Nation

It seems that every week lately we have a highly anticipated event taking place. From Federal Reserve Chair Jerome Powell’s Jackson Hole speech a couple weeks ago, to last week’s Nvidia earnings results, this week’s labor report, next week’s CPI data, and the following week’s Fed meeting. We’re in a real nail biting time, not to mention the seasonal September forces that likely have some investors on edge.

We’re going to focus on the labor market in this piece since that’s the critical data we’ll get on Friday. Last month’s jobs report moved markets in a major way so it’s worth paying close attention to.

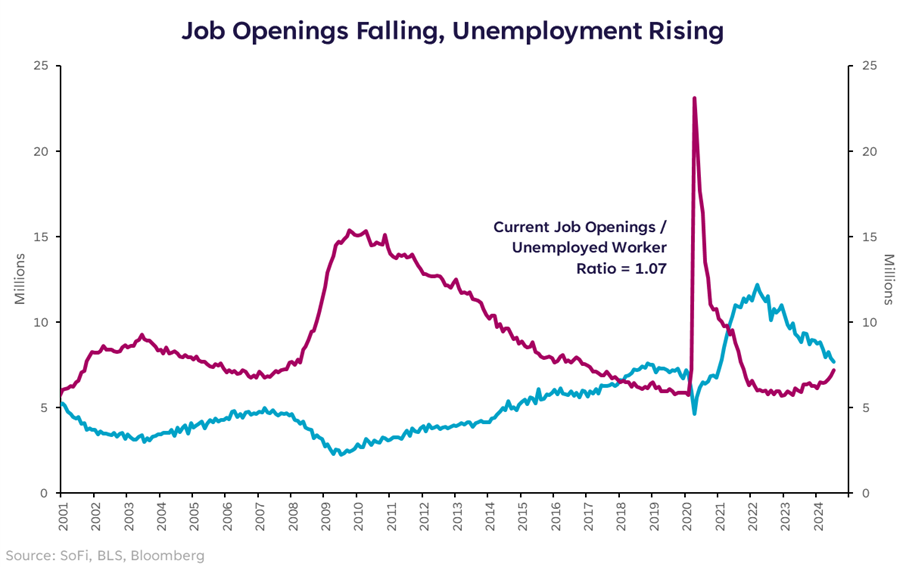

Ahead of the all-important jobs report came the Job Openings Labor Turnover Survey, or JOLTS report, another key labor data point. It’s a measure of how many jobs are available in the U.S. each month, as well as how many people were laid off, or quit their jobs. The data for July came in far below expectations in terms of jobs available; in fact, it brought the ratio of open jobs to unemployed workers down to 1.07, which is the lowest it’s been since April 2018.

To put a positive spin on it, there is technically still more than one job available for each unemployed worker. Additionally, we’ve been through protracted periods of time when that ratio has been below 1 and the economy did just fine. I point this data out not to sound alarm bells, but to highlight that we are moving into a very different environment than we’ve been in for the last few years.

Canaries

But what does a different environment foretell for our economic future? At present, nothing clearly catastrophic or euphoric. That’s the tricky part of the current situation… if things stay where they are, everything is in balance and we (or the Fed) can say we’ve gotten inflation under better control without breaking the labor market. What we can’t know yet is whether we’re simply passing through the “balanced” scenario on our way to “weak.”

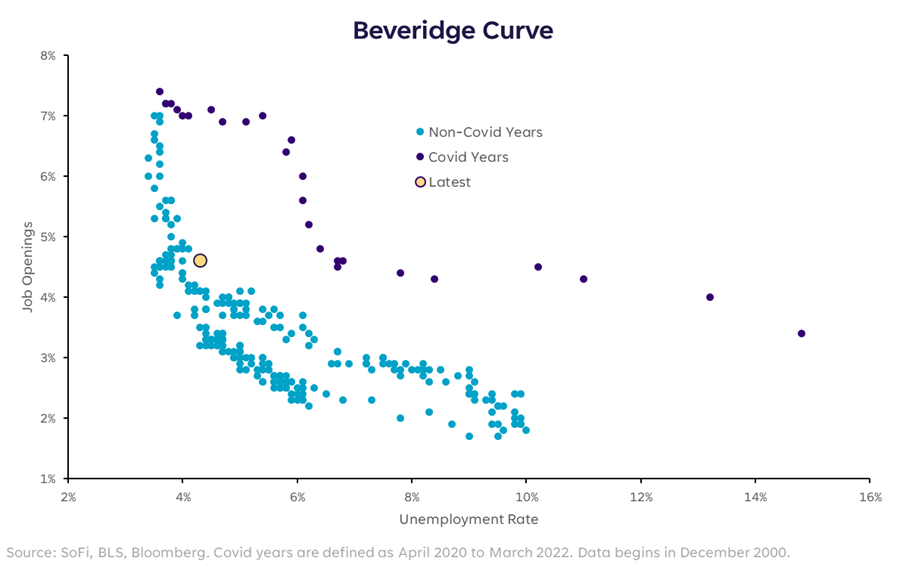

It’s difficult, if not impossible, to use only a couple data sets to predict what might happen in the future. But the downside surprise in JOLTS data is concerning according to the chart below.

The Beveridge Curve illustrates the relationship between the job openings rate (the number of positions open at companies versus total current employees + jobs open) and the broad unemployment rate. The typical relationship shows that as the job openings rate falls (which it is currently doing), the unemployment rate rises

.

We are clearly not in concerning territory at present, but if the trend holds and job openings continue to fall, this suggests that last month’s rise in unemployment could have been the beginning of further weakening.

Looming Labor

Nevertheless, the consensus expectation for Friday’s unemployment rate sits at 4.2%, which would be a tick down from last month’s 4.3%. Surely, a reduction in the unemployment rate would be an indication that things have remained stable, but anything above estimates is likely to be interpreted negatively by markets.

As I wrote about in my column from August 15, labor market data is now more important for market direction than inflation data. Friday’s jobs report will be the last such data we get before the Fed’s highly anticipated September meeting, and is therefore likely to be the most important factor to determine whether it will cut rates by 25 basis points or 50. The September nailbiter continues, and doesn’t appear to be letting up anytime soon.

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, investment advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.