Week Ahead on Wall Street: Is the Future Now?

Estimated reading time: 0 minutes

AI Chips and Dip

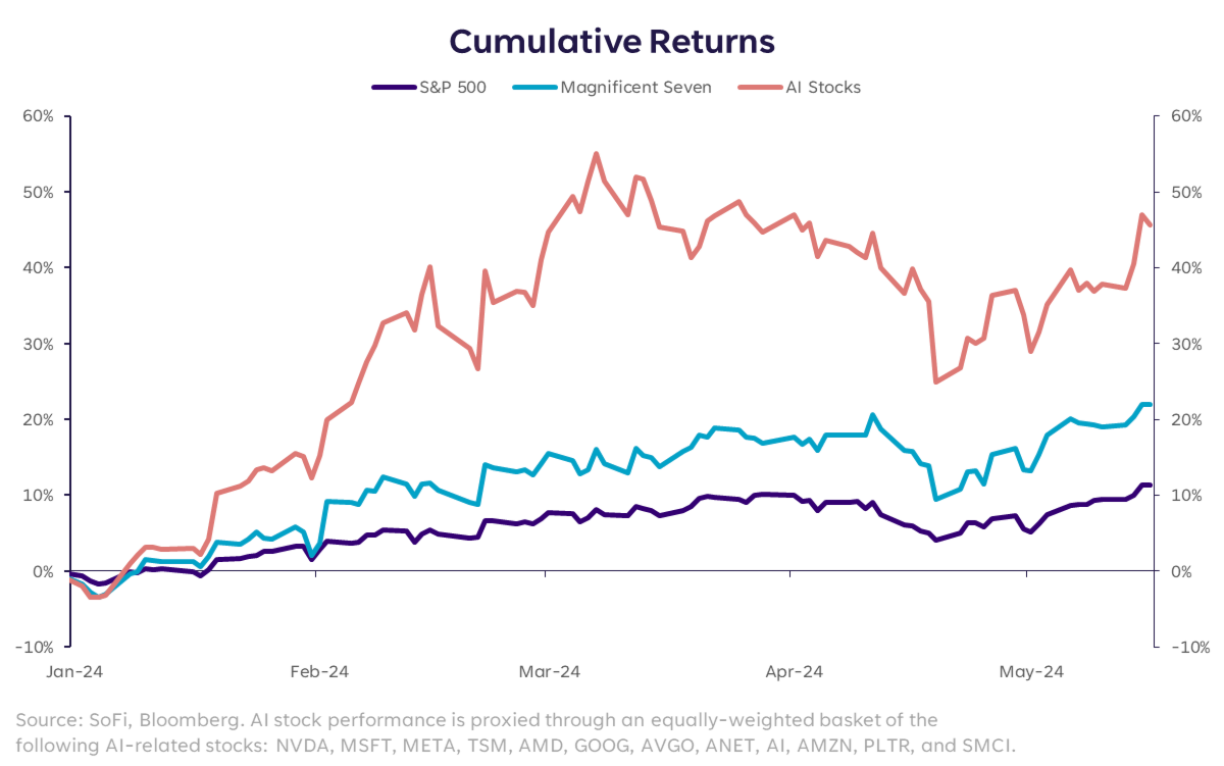

ChatGPT launched to the masses on November 30, 2022, sparking a new wave of interest in generative AI – both as a technology and an investment theme. Companies across industries are promising to incorporate AI and getting a lot of love from investors for it: A basket of AI-related stocks has quadrupled the rate of return of the S&P 500 so far this year, and more than doubled the return of the “Magnificent Seven” tech darlings, as shown in the chart below.

Investors hope that the technology will lead to increased productivity and boost economic growth. Of course, this will likely play out over years or even decades, making it hard to distinguish between rational excitement and irrational exuberance.

NVIDIA stands at the vanguard of this technological revolution. As the dominant designer and supplier of high-powered AI chips, it plays an influential role in the broader theme and market as a result. And, as such, its earnings results – which will be announced on Wednesday – have taken on outsized importance. Just like investors tune in monthly when nonfarm payrolls or inflation reports get released, the release of NVIDIA’s results have taken on macro-level importance. Poor guidance from the company could take the wind out of AI’s sails, as an investment at least, and put an end to the recent rally. Strong guidance, on the other hand, could be the fuel for the next leg of this bull market.

Economic and Earnings Calendar

Monday

- Fedspeak: Atlanta Fed President Raphael Bostic will give welcome remarks at the Atlanta Fed’s Financial Markets Conference. Fed Vice Chair for Supervision Michael Barr will give a keynote address at the Atlanta Fed’s Financial Markets Conference on bank supervision and regulation, and then participate in Q&A. Fed Governor Christopher Waller will give welcoming remarks at the Third Conference on the International Roles of the US Dollar. Fed Vice Chair Philip Jefferson will discuss the U.S economic outlook and house price dynamics. Atlanta Fed President will moderate a keynote address by Harvard’s Ed Glaeser at the Atlanta Fed’s Financial Markets Conference.

- Earnings: Keysight Technologies (KEYS), Nordson (NDSN), Palo Alto Networks (PANW)

Tuesday

- May Philadelphia Fed Non-Manufacturing Activity: The Philadelphia Fed’s survey of services executives in the region on business conditions and their outlook.

- Fedspeak: Richmond Fed President Thomas Barkin will give welcome remarks at the Richmond Fed’s Investing in Rural America conference. Fed Governor CHrstiopher Waller will speak on the economic and monetary policy outlook. New York Fed President John Williams will give welcome remarks at the 2024 Governance and Culture Reform Conference. Atlanta Fed President Raphael Bostic will give welcome remarks at the Atlanta Fed’s Financial Markets Conference. Fed Vice Chair for Supervision Michael Barr will participate in a fireside chat on the economic outlook, lessons learned from the 2023 liquidity crisis and regional banking supervision. Boston Fed President Susan Collins and Cleveland Fed President Loretta Mester will participate in a panel discussion moderated by Atlanta Fed President Raphael Bostic at the Atlanta Fed’s Financial Markets Conference.

- Earnings: AutoZone (AZO), Lowe’s Companies (LOW)

Wednesday

- April Existing Home Sales: Most home transactions in any given month tend to come from the existing market, and as a result set the tone for the broader housing market.

- FOMC Meeting Minutes: The Federal Reserve releases detailed notes of every FOMC meeting three weeks after their conclusion. Investors often look for more information on Fed officials’ views for hints on the outlook for interest rates and the economy.

- Weekly Mortgage Applications: Mortgage activity gives insight on demand conditions in the housing market.

- Fedspeak: Chicago Fed President Austan Goolsbee will give welcome remarks at the Chicago Fed Holding Company Symposium.

- Earnings: Analog Devices (ADI), NVIDIA (NVDA), Synopsys (SNPS), Target (TGT), TJX Companies (TJX)

Thursday

- April Factory and Durable Goods Orders: These metrics give insight into underlying trends for leading cyclical indicators.

- April Chicago Fed National Activity Index: This is a monthly index put together by this regional Fed that incorporates 85 indicators from four categories

- May S&P Global US PMIs: These indexes track how purchasing managers across different industries feel about the business environment.

- April New Home Sales: While only a minority of home transactions in any given month come from new constructions, these home prices tend to be more cyclical and give insight into developing trends.

- May Kansas City Fed Manufacturing Activity: The Kansas City Fed’s survey of manufacturing executives in the region on business conditions and their outlook.

- May University of Michigan Consumer Sentiment: How consumers feel about economic conditions affect their spending habits. This survey places a particular focus on inflation and its trajectory.

- Weekly Jobless Claims: This high frequency labor market data gives insight into filings for unemployment benefits. Jobless claims have continued to show a labor market that remains strong despite having cooled.

- Fedspeak: Atlanta Fed President Raphael Bostic will participate in a Q&A session at a Stanford MBA class.

- Earnings: Deckers Outdoor (DECK), Intuit (INTU), Medtronic (MDT), Ralph Lauren (RL), Ross Stores (ROST)

Friday

- Fedspeak: Fed Governor Christopher Waller will give a keynote address at a Central Bank of Iceland event on R*, the neutral rate of interest.

- Earnings: Autodesk (ADSK), Dollar Tree (DLTR)

Disclaimer

SoFi Securities (Hong Kong) Limited and its affiliates (SoFi HK) may post or share information and materials from time to time. They should not be regarded as an offer, solicitation, invitation, investment advice, recommendation to buy, sell or otherwise deal with any investment instrument or product in any jurisdictions. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

SoFi HK does not make any warranties about the completeness, reliability and accuracy of this information and will not be liable for any losses and/or damages in connection with the use of this information.

The information and materials may contain hyperlinks to other websites, we are not responsible for the content of any linked sites. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi HK. These links are provided for informational purposes and should not be viewed as an endorsement. The risk involved in using such hyperlinks shall be borne by the visitor and subject to any Terms of Use applicable to such access and use.

Any product, logos, brands, and other trademarks or images featured are the property of their respective trademark holders. These trademark holders are not affiliated with SoFi HK or its Affiliates. These trademark holders do not sponsor or endorse SoFi HK or any of its articles.

Without prior written approval of SoFi HK, the information/materials shall not be amended, duplicated, photocopied, transmitted, circulated, distributed or published in any manner, or be used for commercial or public purposes.

About SoFi Hong Kong

SoFi – Invest. Simple.

SoFi Hong Kong is the All-in-One Super App with stock trading, robo advisor and social features. Trade over 15,000 US and Hong Kong stocks in our SoFi App now.